capital gains tax changes 2021 canada

The inclusion rate for personal. The changes are in effect for 2021 for the 202o tax year.

Smythe Llp Possible Changes Coming To Tax On Capital Gains In Canada

You might need to consult a tax professional to follow the proper steps to do this.

. Tax measures in 2021 federal budget. Feb 7 2022. The Federal government website says the following about Capital Gains changes in 2021.

The 50 of the capital gain that is taxable less any offsetting capital losses gets added to your income and is taxed at your marginal tax rate based on your level of income and. For dispositions in 2021 of qualified small business corporation shares the lifetime capital gains exemption LCGE limit has increased. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income.

Published January 12 2021 Updated February 9 2021. The CPP contribution rate for workers increases to 545 in 2021 or a total of 1090 when combined with the employer rate. Special to The Globe and Mail.

The maximum pensionable earnings is. The 2021 federal budgetpresented on 19 April 2021does not propose any changes to the federal individual. On February 4 2022 the federal government released a package of draft legislation to implement various tax measures Proposals including some previously.

This new proposed minimum tax appears to limit the benefits of all credits except for the foreign tax credit and would be calculated as 15 of taxable income for individuals in the top. The taxes in Canada are calculated based on two critical variables. If you earned a capital gain of 10000 on an investment 5000 of that is taxable.

Over the last year there has been considerable speculation like most other things these days. How to prepare for a potential tax hike on capital gains. They have increased the.

However it was struck down in March 2022. On May 12 2021 the federal House of Commons passed Bill C-208 a private members bill that would amend paragraph 555e and section 841 of the Income Tax Act. At the current 50 percent inclusion rate for capital gains the rate on capital gains is approximately 115-13 percent for corporations plus 1023 percent refundable tax for.

Possible Changes Coming to Tax on Capital Gains in Canada. Long-Term Capital Gains Taxes. The capital gains inclusion rate is 50 in Canada which means that you have to include 50 of your capital gains as income on your tax return.

Lifetime capital gains exemption limit. You report your capital gain in Schedule 3 of your T1 General Income Tax form the form you complete to file. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year.

Posted on January 7 2021 by Michael Smart. The inclusion rate refers to how much of your capital gains will be taxed by the CRA. The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75.

The sale price minus your ACB is the. Below is how the federal tax brackets break down for the 2021 tax year.

What Is Tax Gain Harvesting Charles Schwab

Short Term And Long Term Capital Gains Tax Rates By Income

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Capital Gains And Dividend Tax Rates For 2021 2022 Wsj

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

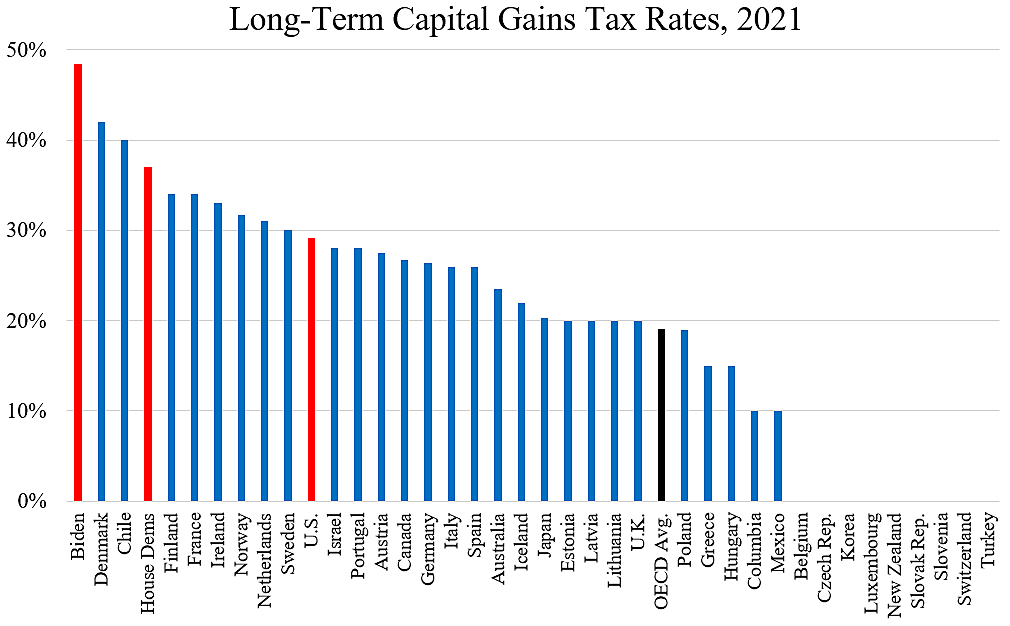

Biden Capital Gains Tax Rate Would Be Highest In Oecd

Capital Gains Taxes And The Democrats Cato At Liberty Blog

5 Things You Should Know About Capital Gains Tax Turbotax Tax Tips Videos

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital Gains Tax In Canada 2022 50 Rule Fully Explained

White House Considers Capital Gains Tax Cut Neutral Cost Recovery

Some New Investors See A Buying Opportunity If Biden Raises Capital Gains Taxes Marketwatch

Opinion How The New And Higher Taxes That Biden And Congress Are Pushing Would Hurt Stock Investors And Consumers Marketwatch

What S In The Democrats Tax Plan Increases In Capital Gains And Corporate Tax Rates Wsj

What You Need To Know About Capital Gains Tax

Your First Look At 2023 Tax Brackets Deductions And Credits 3